NEWPORT –– A report released today by the Vermont State Auditor provides new details on the State of Vermont’s oversight of the Jay Peak EB-5 projects, revealing lapses that may have contributed to the multi-million dollar fraud perpetrated by the project’s developers.

The EB-5 program provides green cards to foreign investors who invest at least $500,000 in approved U.S. projects. Between 2006 and 2016, 854 foreign investors invested $427 million in eight projects at the Jay Peak and Burke Mountain ski resorts in Vermont’s Northeast Kingdom region. However, the developers misused a significant portion of these funds.

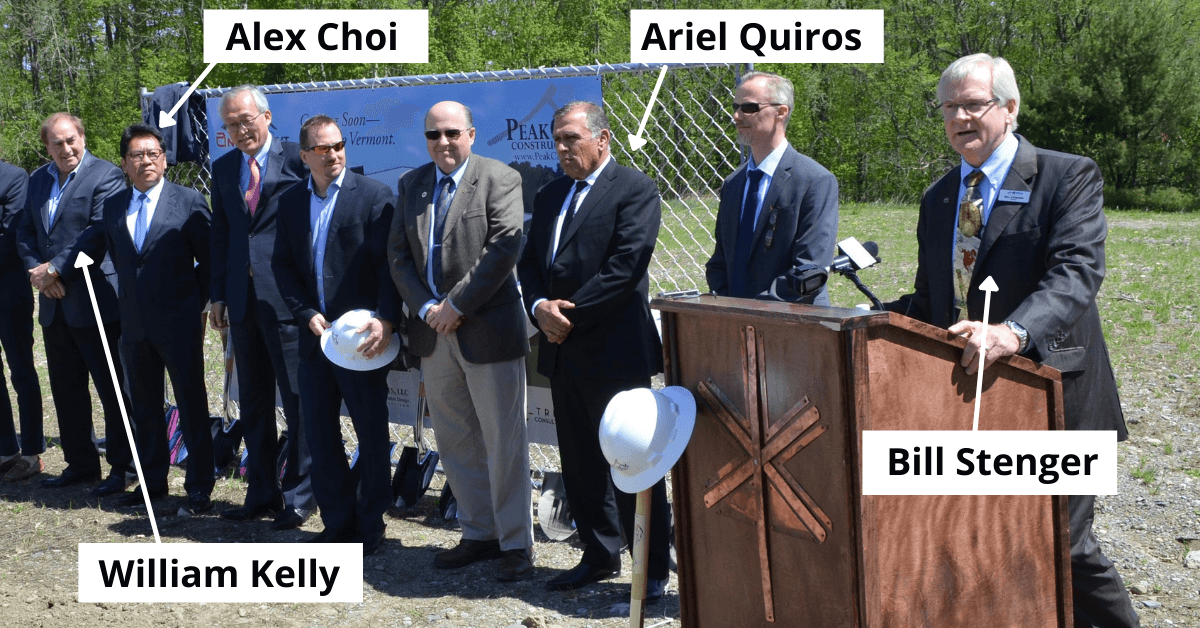

The fraud was orchestrated by three individuals: Ariel Quiros, the owner of Jay Peak; William “Bill” Stenger, the CEO of Jay Peak; and William “Bill” Kelly, an advisor to Quiros. Quiros, who purchased Jay Peak using EB-5 funds, was sentenced to five years in prison for his role in the scheme. Stenger, who the U.S. Attorney’s Office said “spearheaded” the eight EB-5 projects, received an 18-month sentence. Kelly, described as Quiros’ “key advisor,” also received 18 months. The three men pleaded guilty to charges including fraud and making false statements.

The Auditor’s report highlights the AnC Bio Vermont project, a proposed biomedical research facility, as a particularly egregious example of fraud. The project collected $84.5 million from 169 investors, but according to the U.S. Attorney’s Office, “The [AnC Bio Vermont] project was a ghost, no products, no customers, no clean rooms, no FDA approval, not so much as an application, absolutely nothing to show but empty space and missing investor money.” Despite these red flags, the State allowed the project to continue soliciting investors until 2016.

Key findings from the State Auditor’s report include:

- The Vermont Agency of Commerce and Community Development (ACCD), which oversaw the projects, lacked written policies and procedures and kept few records of its oversight activities. There is little documentation showing how ACCD approved the projects or what was discussed in quarterly meetings with the developers.

- ACCD did not require financial audits of the projects, even after the developers reneged on a verbal agreement to conduct an audit in 2012. The Auditor found that ACCD had three opportunities to require audits as a condition of approving the final two projects in 2012 and 2013, but failed to do so.

- Some marketing materials falsely claimed that the State of Vermont was auditing the EB-5 projects. While the report found no evidence that State officials claimed to be conducting financial audits specifically, officials’ use of the term “audit” without clarification may have misled investors.

The Auditor’s report highlights several instances where marketing materials for the Jay Peak projects claimed that the developments were being audited by the State of Vermont. For example, brochures from a major Jay Peak promoter stated that “the State audits each EB-5 Project on a quarterly basis.” The Governor also appeared in a 2012 promotional video, stating that Vermont’s EB-5 projects are “audited by the State of Vermont.” While State officials denied claiming to conduct financial audits, the Auditor concludes that the lack of clarity around the term “audit” likely gave investors incorrect assurances about the level of State oversight.

- As ACCD’s concerns about the projects grew in 2014, the department sought assistance from the Department of Financial Regulation (DFR). After taking over oversight, DFR investigated the Jay Peak projects and worked with the SEC to bring enforcement actions against the developers in 2016.

- As of January 2024, over 60% of investors in the Jay Peak projects had received green cards, while only 6% of investors in the Burke Mountain project had received permanent residency. Most investors have recouped only a small portion of their $500,000 investment.

The Auditor’s report concludes that while the developers actively deceived the State, a more proactive approach by ACCD could have potentially mitigated investor losses. The full report is available on the State Auditor’s website through this link.