In today’s complex financial markets, you have an impressive array of investment vehicles from which to select. Each investment also carries some risk, making it important to choose wisely if you are selecting just one.

The good news is that there’s no rule that says you must stick with only one type of investment. In fact, you can potentially lower your investment risk and increase your chances of meeting your investment goals by practicing “asset allocation.”

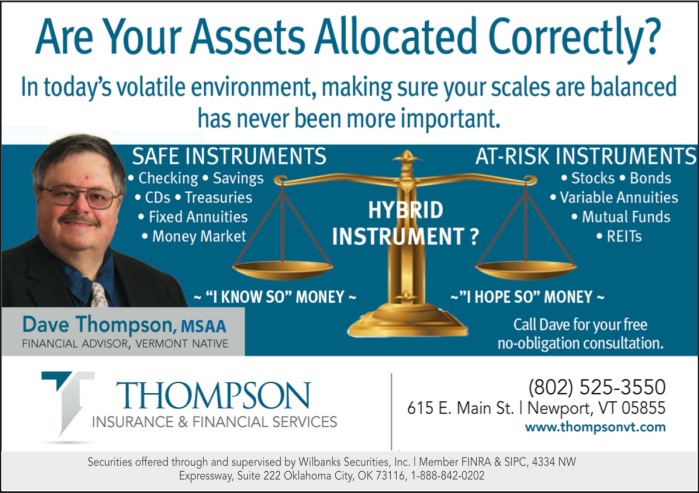

Asset allocation refers to the way you weight diverse investments in your portfolio in order to try to meet a specific objective. For instance, if your goal is to pursue growth (and you are willing to take on market risk in order to do so), you may decide to place 20% of your assets in bonds and 80% in stocks.

The asset classes you choose, and how you weight your investment in each, will probably hinge on your investment time frame and how that matches with the risks and rewards of each asset class; stocks, bonds and money markets.

Before exploring just how you can put an asset allocation strategy to work to help you meet your investment goals, you should first understand how diversification works hand in hand with asset allocation.

Diversification simply is the process of helping reduce risk by investing in several different types of individual funds or securities. When you diversify your investments among more than one security, you help reduce what is known as “single-security risk,” or the risk that your investment will fluctuate widely in value with the price of one holding.

Diversifying among several asset classes increases the chances that, if and when the return of one investment is falling, the return of another in your portfolio may be rising, thus leveling out the big peaks and valleys (though there are no guarantees). Neither asset allocation nor diversification guarantee against market loss.

Points to Remember:

Asset allocation is the way in which you spread your investment portfolio among different asset classes, such as stocks, bonds, stock mutual funds, and bond mutual funds.

When prices of different types of assets do not move in tandem, combining these investments in a portfolio can help reduce the variability of returns, commonly known as “market risk.”

Mutual funds are pools of securities, usually offering diversification within a single asset class. Some mutual funds may include several asset classes.

The asset allocation that is right for you depends on your investment time frame and risk tolerance.

As your investment time frame and goals change, so might your asset allocation. Many financial experts suggest reevaluating your asset allocation periodically or whenever you experience a milestone event in your life such as a marriage, the birth of a child or retirement.

This sponsored post was written by David W. Thompson, MSAA. He is the principal agent and financial advisor of Thompson Insurance & Financial Services. He has been working in the insurance and financial services for over 15 years helping Vermonters to secure their future. For more information please visit him at: www.thompsonvt.com

Securities offered through and supervised by Wilbanks Securities, Inc. Member FINRA & SIPC.

4334 NW Expressway, Suite 222 Oklahoma City, OK 73116. 1-888-842-0202.